Despite widespread speculation that retail investors have abandoned the crypto market, Vugar Usi Zade, Chief Operating Officer of Bitget, says this couldn't be further from the truth.

In an exclusive interview with Cointelegraph at the Consensus conference in Toronto, Canada, Usi Zade explained that while speculative trading has cooled off, retail interest in cryptocurrency remains strong — just in a different form. Investors are now shifting toward practical, utility-driven use cases , rather than short-term pump-and-dump strategies.

This behavioral shift, he noted, stems from lingering caution following the last crypto bear market and ongoing macroeconomic uncertainty — particularly policies linked to the Trump administration that have placed downward pressure on risk assets throughout 2025. “Retail investors’ appetite for risk is much lower because we know what happened with the stock market and every other aspect,” Usi Zade said. “There’s less disposable income to play around with, but people are becoming smarter with their investments.”

To align with these evolving user preferences, Bitget is expanding into crypto payments and stablecoin services , including its own payment gateway, Bitget Pay . The move reflects a broader industry trend where users are increasingly adopting digital assets for everyday transactions rather than just investment or trading.

The fallout from the 2021 bull run — followed by major exchange collapses and a prolonged bear market — has driven many users to seek safer, more functional applications for their crypto holdings.

Usi Zade added:

“Several exchanges are tapping into the payment processing market through crypto, which brings us more toward retail use and everyday spending habits, rather than just earning or trading.”

He also highlighted the growing influence of decentralized exchanges (DEXs) , which now account for nearly 10% of the crypto derivatives market . These platforms allow early access to new tokens not yet listed on centralized exchanges, making them increasingly popular among risk-tolerant traders.

“People still want to do big things,” Usi Zade said, “but not necessarily within the formal arena.” DEXs enable users to “tap into opportunities very, very early.”

Bitget continues to grow as one of the world’s leading crypto exchanges, reporting over $3.4 billion in average daily trading volume as of May 31, according to CoinMarketCap. While the platform lists over 800 cryptocurrencies on its centralized exchange, it offers access to millions more via Bitget Onchain , which supports cross-chain trading across hundreds of decentralized exchanges.

Related: [Bank lobby is ‘panicking’ about yield-bearing stablecoins — NYU professor]

According to Usi Zade, the days of full-blown bull and bear markets — defined by euphoric rallies and multi-year crashes — are likely over. Instead, he predicts a future of "bull episodes" and "bear episodes" , where smaller, short-lived trends dominate.

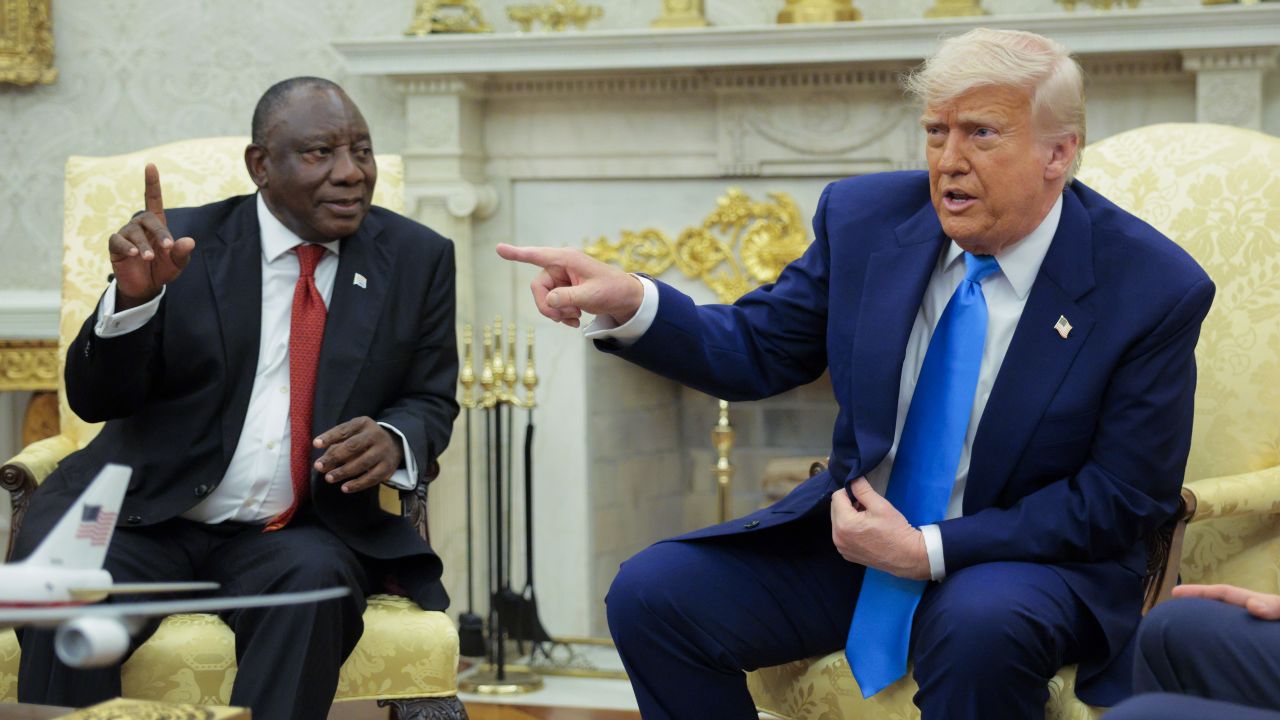

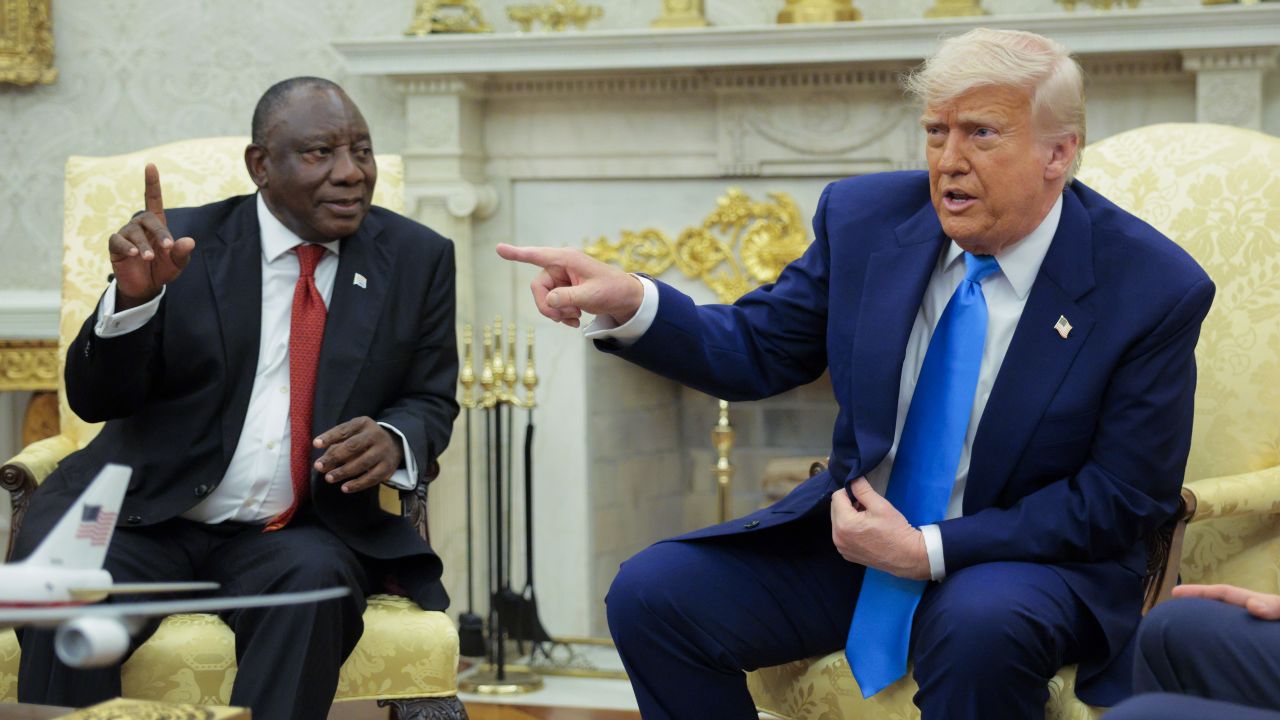

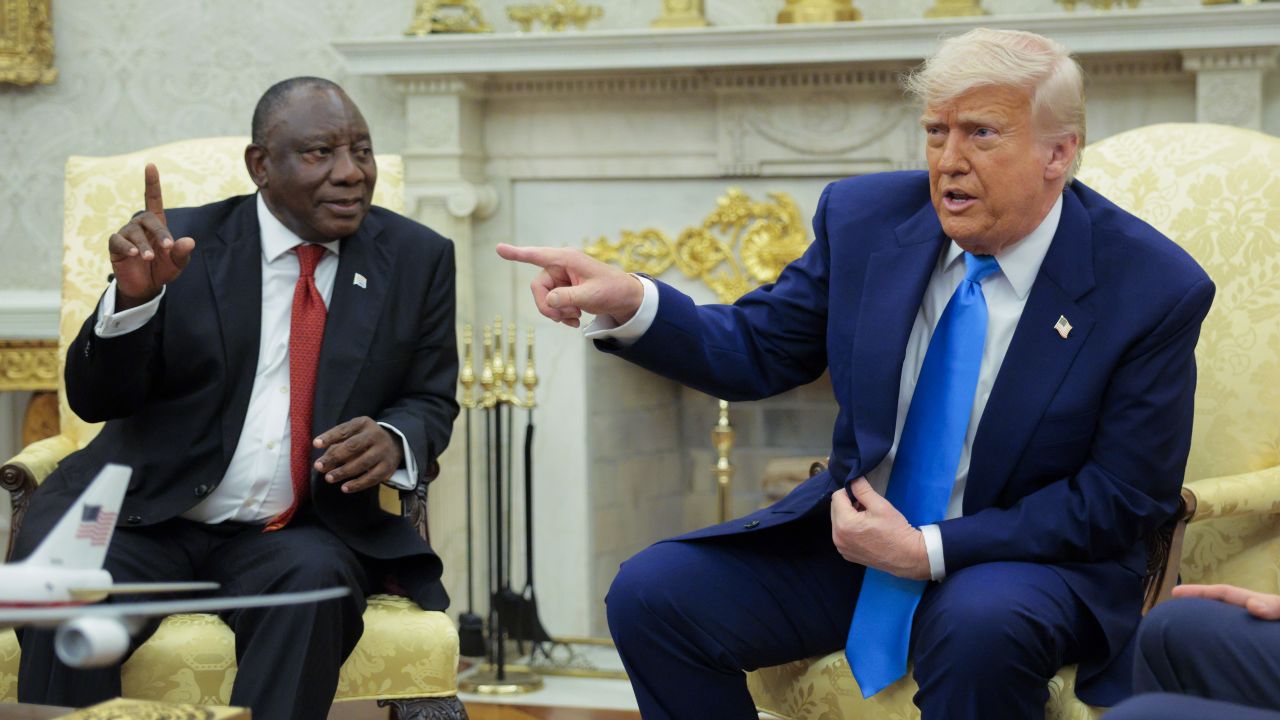

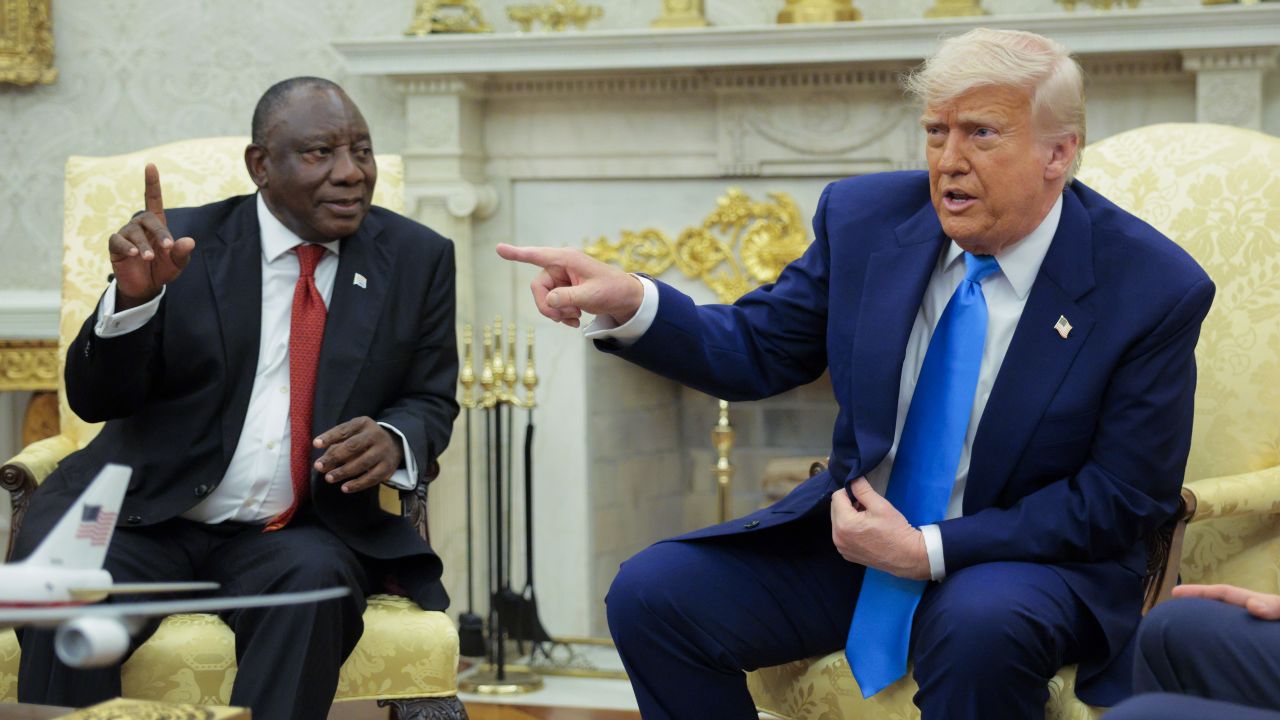

Bitcoin, he noted, remains the biggest outlier in the space. Trading in what he described as “its own free flow,” BTC has become both a haven asset and a speculative vehicle influenced by traditional financial forces like ETF inflows, monetary policy changes, and even social media posts from figures like U.S. President Donald Trump.

With ETFs drawing increased institutional attention, Bitcoin is gaining mainstream traction. However, this also means it's becoming more sensitive to external economic pressures — blurring the line between crypto and traditional finance.

“Therefore, it’s a very interesting place to be,” Usi Zade concluded, “and I think as an exchange, we are trying to reinvent ourselves — first with all the regulations and KYCs; we are becoming more of a bank-like organization.”

Trump has been boasting that the large tariffs he slapped on many countries (an…

Robox News

Robox News

Punjab Kings' bowlers showcased a disciplined performance, restricting Royal Ch…

Robox News

Robox News

Ford on Tuesday reported a 16.3% year-over-year U.S. sales increase for May, as…

Robox News

Robox News

I eavesdropped on 12 million tech workers. What I overheard was frightening.

Robox News

Robox News