Bitcoin dropped to a nine-day low, trading near $105,727 on Friday, as renewed volatility rattled crypto markets. The decline comes amid broader economic concerns, including stalled U.S.-China trade talks and a U.S. court ruling reinstating certain tariffs, which have dampened investor sentiment. However, analysts suggest this pullback is a normal market adjustment rather than a long-term bearish signal. Ethereum and major altcoins like Cardano and Dogecoin also saw downward movement.

The crypto market’s total capitalization fell 2.43% to $3.35 trillion, while 24-hour trading volume rose to $184.7 billion, according to Riya Sehgal, Research Analyst at Delta Exchange. The dip coincided with $725 million in liquidations, reflecting heightened short-term uncertainty.

Sathvik Vishwanath, Co-founder and CEO of Unocoin, noted that after Bitcoin’s recent rally to an all-time high of $111,000, a temporary correction was inevitable. “Experienced investors recognize these phases as part of the market’s natural cycle—driven by profit-taking, macro risks, and shifting sentiment,” he said. Factors like U.S. trade policy shifts and regulatory speculation have added to the cautious mood.

Historically, Bitcoin has seen sharp rallies followed by consolidation before reaching new highs. Despite the dip, long-term holders remain steady, and declining exchange reserves suggest institutional confidence remains intact.

Ashish Singhal, Co-founder of CoinSwitch, emphasized that such fluctuations are normal in crypto. “Bitcoin’s dip isn’t surprising after its recent surge. Global events, like renewed trade barriers, have triggered short-term jitters, but fundamentals remain solid,” he said. Retail investment in India and other markets continues to show resilience, signaling sustained interest.

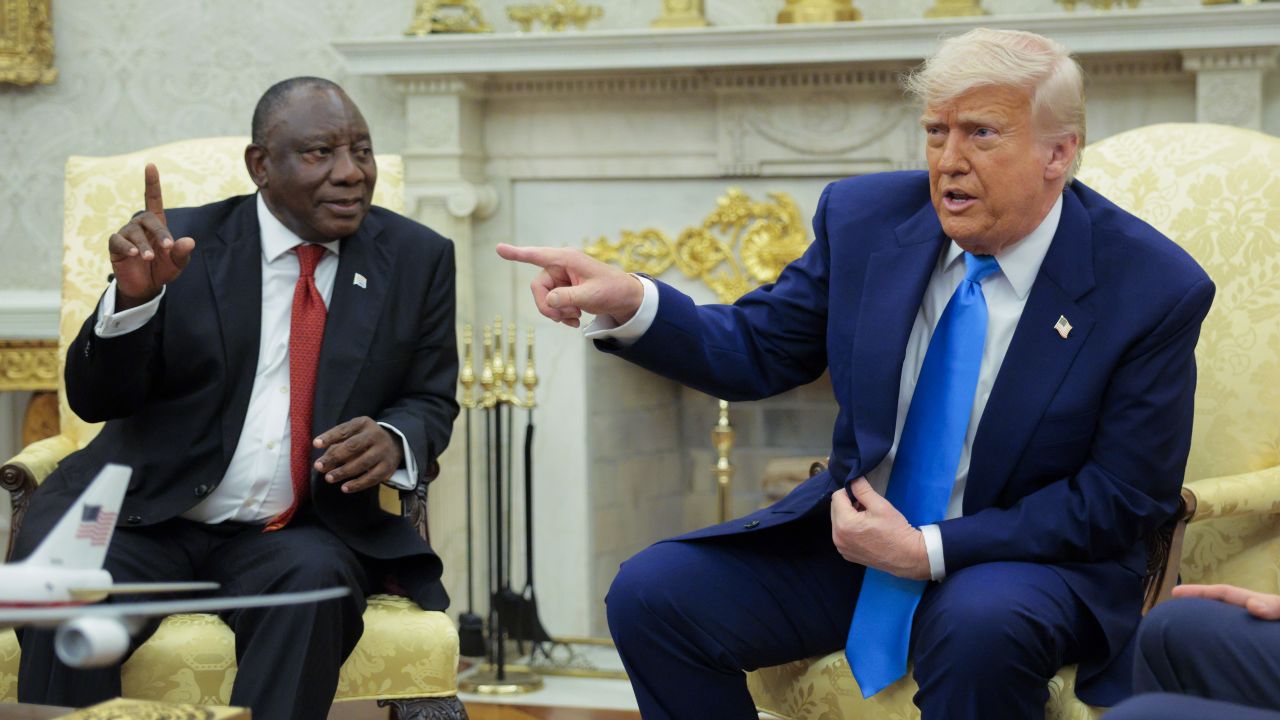

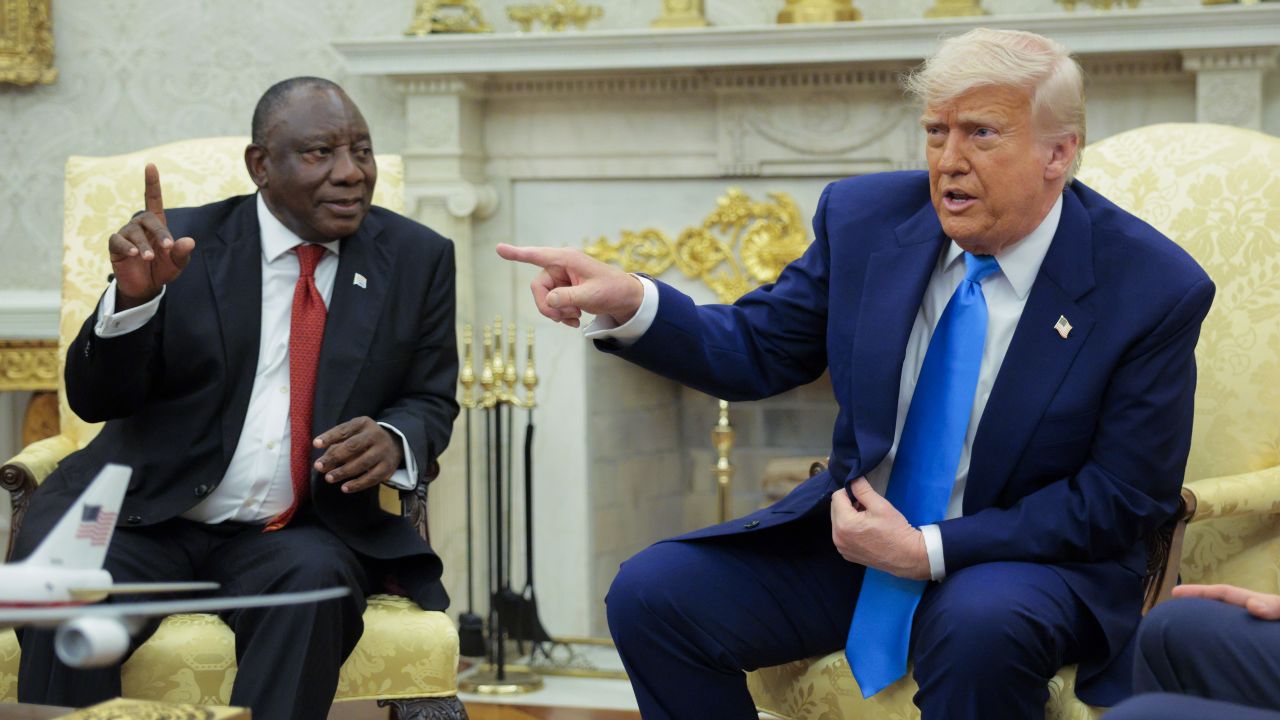

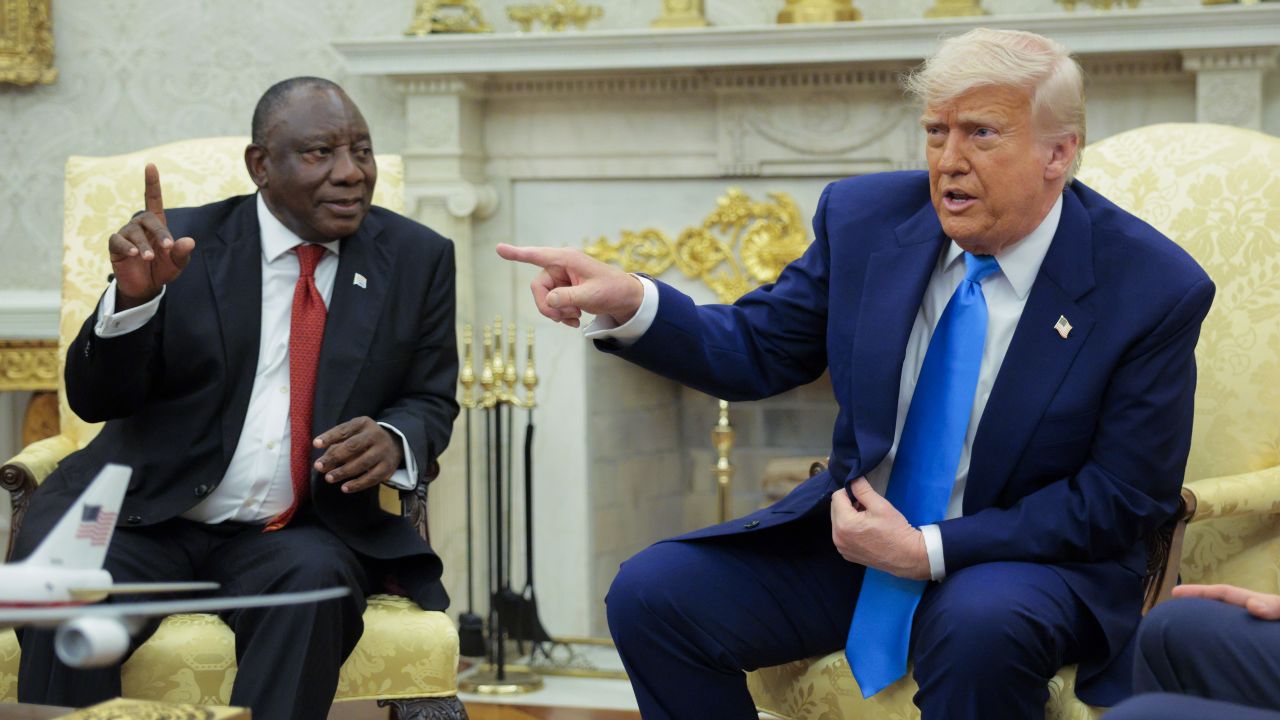

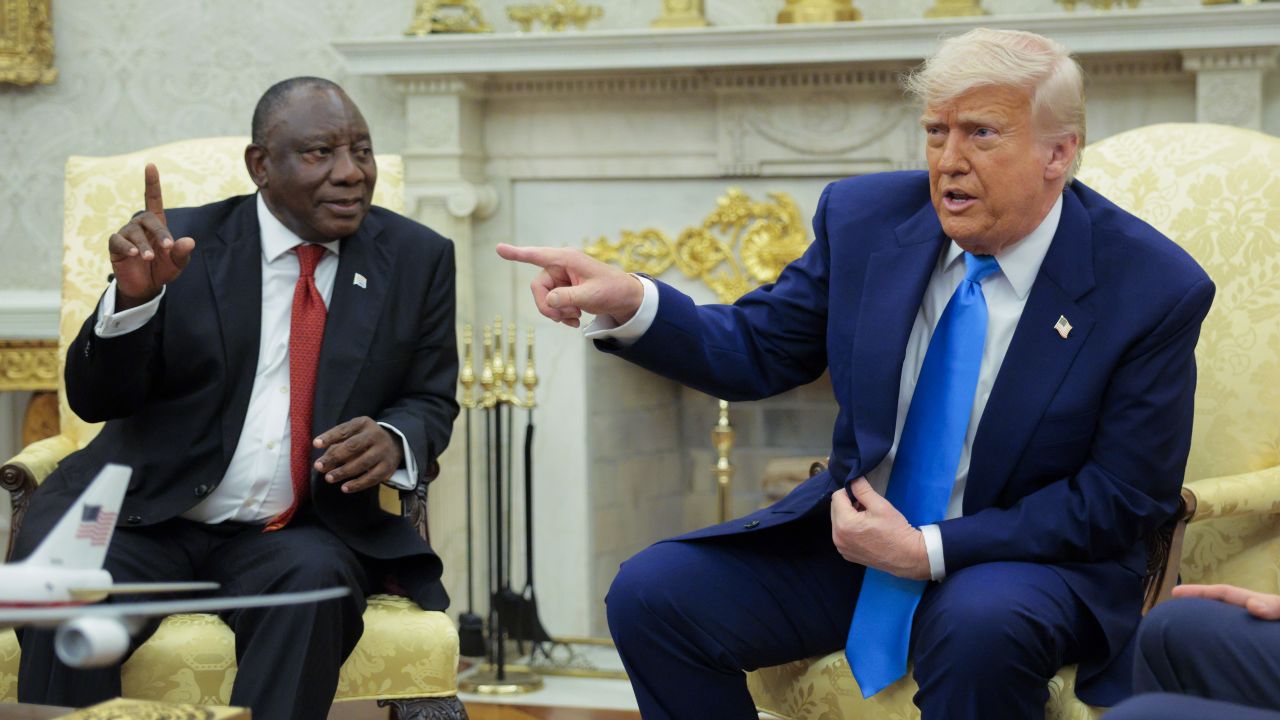

Trump has been boasting that the large tariffs he slapped on many countries (an…

Robox News

Robox News

Punjab Kings' bowlers showcased a disciplined performance, restricting Royal Ch…

Robox News

Robox News

Perhaps due to PTSD from the last crypto market cycle and a challenging macro b…

Robox News

Robox News

Ford on Tuesday reported a 16.3% year-over-year U.S. sales increase for May, as…

Robox News

Robox News